The PDR process revolutionizes insurance claims for minor vehicle damage, offering quicker and cheaper repairs. By analyzing key metrics like costs and satisfaction, insurers assess PDR's effectiveness in reducing expenses and timescales. A rigorous Quality Assurance process ensures accurate assessments and high-quality repairs, fostering trust among policyholders.

“Uncovering the intricacies of how insurance companies assess the PDR (Process Data Results) process is essential for understanding repair quality and customer satisfaction. This article delves into the three critical aspects: deciphering the key components of PDR, exploring data analysis techniques used by insurers to interpret results, and examining quality assurance measures ensuring fair and precise assessments. By the end, readers will grasp the multifaceted role of PDR in shaping post-repair experiences.”

- Understanding PDR: Key Components and Its Role

- Data Analysis: Metrics Used by Insurance Providers

- Quality Assurance: Ensuring Fair and Accurate Assessments

Understanding PDR: Key Components and Its Role

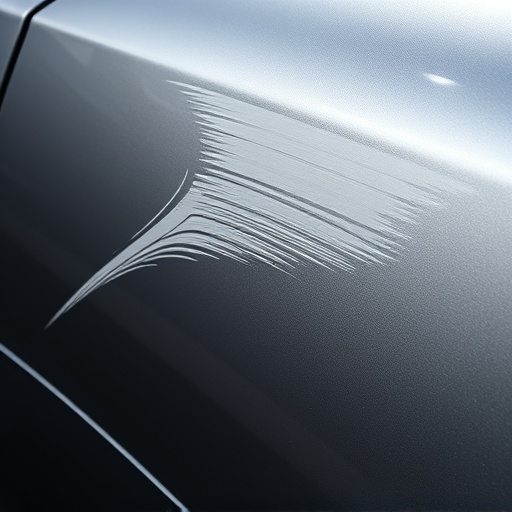

The PDR (Paintless Dent Repair) process has revolutionized the way insurance companies handle vehicle damage claims. This non-invasive method focuses on removing dents and dings from a vehicle’s exterior without painting, offering a faster and more cost-effective solution for both insurers and policyholders. Key components of the PDR process include assessing the extent of the damage, using specialized tools to push out the dent, and ensuring a smooth finish that matches the original paint job.

By adopting PDR, insurance companies streamline their claims processing, reducing repair times and costs. This not only benefits insurers by minimizing administrative burdens but also policyholders by expediting vehicle repairs. Additionally, PDR is ideal for minor damage, such as door dings and small dents, making it a preferred choice when it comes to auto glass replacement or vehicle dent repair. The process ensures that vehicles are restored to their pre-incident condition, maintaining their value and aesthetics.

Data Analysis: Metrics Used by Insurance Providers

Insurance companies meticulously analyze data to evaluate the outcomes of the PDR (Pre-Damage Repair) process. Key metrics include repair costs, time taken for completion, and customer satisfaction scores. By examining these factors, insurers can gauge the effectiveness of PDR in minimizing damage and associated expenses for various vehicle types, including Mercedes Benz repairs. For instance, they might compare the cost of PDR against traditional bumper repair to determine if the former offers more economical solutions.

Additionally, data analysis involves tracking post-PDR incident rates and claims for car damage repair. This helps insurance providers assess whether PDR leads to reduced claims over time. Such insights are crucial in refining their assessment methods and ensuring fair pricing strategies for policyholders, be it for bumper repair or other types of vehicle restoration.

Quality Assurance: Ensuring Fair and Accurate Assessments

Insurance companies employ a rigorous Quality Assurance process to ensure that PDR (Paintless Dent Repair) assessments are fair and accurate. This is crucial in maintaining the integrity of the entire claims settlement procedure. By implementing strict quality standards, insurance providers can safeguard against potential biases or errors that may arise during the evaluation of damage repairs.

The Quality Assurance team meticulously reviews each PDR report, verifying the extent of the repair, the techniques employed, and the final aesthetic results. This involves cross-referencing data from the auto collision center or tire services with industry benchmarks and documented best practices. Such a thorough inspection ensures that only qualified and certified technicians perform repairs, adhering to strict standards, thereby guaranteeing high-quality outcomes for policyholders seeking auto repair services.

The PDR process plays a pivotal role in shaping insurance industry practices, ensuring fair and accurate assessments. By understanding key components like data analysis and quality assurance, insurance companies can effectively evaluate PDR results. This allows for more precise risk management, leading to improved customer satisfaction and business outcomes. Through rigorous metrics and standards, the industry continues to evolve, making the PDR process a valuable tool in navigating complex insurance landscapes.